Understanding the procedure is crucial for accurate assessments, even if property tax calculations in Pakistan might be complicated. Property taxes in 2025 are calculated using location-based multipliers, exemptions, and Annual Rental Value (ARV). To keep you in compliance and prevent overpayment, this document offers a concise explanation of the property tax calculation formula. Understanding how to compute your taxes guarantees that you’re paying the correct amount, regardless of whether you own homes, businesses, or agricultural property.

Table of Contents

What is Property Tax in Pakistan?

Property tax in Pakistan is a government-imposed levy on ownership or occupation of property, whether it’s residential, commercial, or industrial. It is calculated based on the annual rental value (ARV) or assessed value of the property.

Purpose of Property Tax:

- To generate revenue for local governments

- To fund municipal services like sanitation, street lighting, and road maintenance

- To maintain urban infrastructure development

This tax ensures that property owners contribute fairly to the city’s development and upkeep.

Who Collects Property Tax in Pakistan?

Property tax is collected by the respective Excise, Taxation, and Narcotics Control Departments of each province:

- Punjab Excise & Taxation Department

- Sindh Excise & Taxation Department

- KPK and Balochistan Excise Departments

Each province may have slightly different tax rules, rates, and exemptions.

Who Needs to Pay Property Tax in Pakistan? (Updated 2025)

Find out who is liable for property tax in Pakistan and which properties are exempt under the law.

Residential Property Owners

All individuals who own a house, apartment, or flat in urban areas must pay property tax, especially if the property is rented out or has a high market value. The tax is calculated based on the annual rental value (ARV) or size of the property.

Commercial Property Holders

Owners of shops, plazas, warehouses, offices, or rental buildings are required to pay a higher rate of property tax. In most provinces, commercial units are taxed more strictly due to their income-generating nature.

Property Tax Exemptions in Pakistan (2025)

Some properties are exempted under local laws, including:

- Government-owned buildings

- Mosques, churches, and religious places

- Non-profit hospitals and educational institutions

- Properties below a certain rental value (varies by province)

- Properties owned by disabled persons or senior citizens (in some regions)

Always check with your provincial excise department for the latest exemption rules.

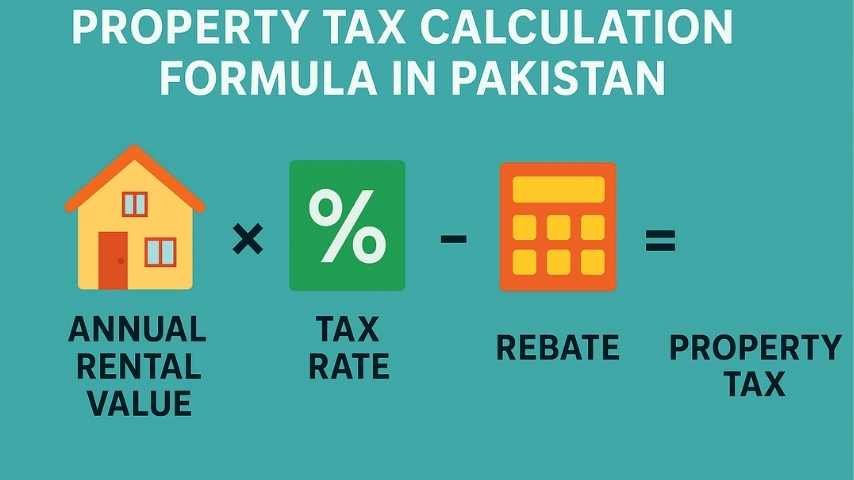

Property Tax Calculation Formula in Pakistan (2025 Method)

Learn how property tax is calculated in Pakistan using the official formula, ARV method, and provincial tax rates.

Property Tax Formula (Standard Method)

The basic formula used to calculate property tax in Pakistan is:

Annual Rental Value (ARV) × Tax Rate = Property Tax

- ARV is the estimated yearly rental income of the property (even if it is not rented).

- Tax Rate varies based on location (urban/rural), property type (residential/commercial), and province.

What is ARV (Annual Rental Value) and How Is It Determined?

ARV is the official rental worth of your property per year, determined by:

- Covered area (in square feet or marla)

- Type of property (residential, commercial, industrial)

- Location and usage

- Construction material and building condition

- Official valuation tables from Excise Department

Even if the property isn’t rented, ARV is applied as if it were.

Tax Rate Differences by Province (2025 Updates)

Each province applies different tax rates. Below is a general idea:

- Punjab: 5% to 25% of ARV (residential/commercial slab-based)

- Sindh: Fixed amount per square foot or per property type

- KPK: Slab-based rates with discounts for early payment

- Balochistan: Lower and more lenient for residential areas

Rates also vary between urban and rural properties and may change annually.

Property Tax Formula Example (Urban Area – 2025 Guide)

Understand property tax calculation with a real-life example using ARV and tax rate in an urban area of Pakistan.

Step-by-Step Example:

Let’s say you own a house in Lahore (urban area) with an estimated market value of Rs. 5,000,000.

➤ Step 1: Estimate the Annual Rental Value (ARV)

According to the Punjab Excise Department, the ARV is usually 10% to 12% of market value for urban residential properties.

ARV = Rs. 5,000,000 × 10% = Rs. 500,000

➤ Step 2: Apply the Tax Rate

Assume a 5% tax rate for this residential slab (actual rate depends on location and covered area).

Property Tax = ARV × Tax Rate

Property Tax = Rs. 500,000 × 5% = Rs. 25,000 per year

Summary Table:

| Detail | Value |

| Market Value of Property | Rs. 5,000,000 |

| Annual Rental Value (ARV) | Rs. 500,000 |

| Applicable Tax Rate | 5% |

| Annual Property Tax Payable | Rs. 25,000 |

Property Tax Formula Example (Commercial Unit – 2025 Guide)

Understand the differences in property tax between commercial and residential units and the special considerations for shops, plazas, etc.

Step-by-Step Example:

Let’s say you own a commercial plaza in Islamabad with a market value of Rs. 15,000,000.

➤ Step 1: Estimate the ARV (Annual Rental Value)

For commercial properties in Islamabad, ARV is typically 15% to 18% of the market value.

ARV = Rs. 15,000,000 × 18% = Rs. 2,700,000

➤ Step 2: Apply the Tax Rate

In most urban areas, commercial properties attract a higher tax rate. In Islamabad, this could be 25% for a plaza.

Property Tax = ARV × Tax Rate

Property Tax = Rs. 2,700,000 × 25% = Rs. 675,000 per year

How Commercial Tax Differs from Residential Property Tax

- Higher Tax Rates: Commercial properties usually have higher tax rates (15% to 30%) compared to residential properties (5% to 10%).

- ARV Differences: Commercial units like plazas, shops, and office buildings are assessed at a higher ARV percentage due to their potential for income generation.

Special Considerations for Plazas, Shops, and Other Commercial Units

- Plazas and Shops:

- These properties are taxed at a higher rate because they are income-generating.

- The area and location significantly impact the ARV.

- Special Valuation Methods:

- The Excise Department may use fixed rates per square foot for smaller shops or slab-based calculations for larger commercial properties.

- Additional Tax for Commercial Usage:

- If the commercial property is used for a business purpose, such as a restaurant, shop, or office, there may be additional taxes or levies imposed based on the nature of the business.

Summary Table for Commercial Property Example:

| Detail | Value |

| Market Value of Property | Rs. 15,000,000 |

| Annual Rental Value (ARV) | Rs. 2,700,000 |

| Applicable Tax Rate | 25% |

| Annual Property Tax Payable | Rs. 675,000 |

Latest Property Tax Rates in 2025 (Punjab, Sindh, KPK)

Check out the updated property tax rates for 2025, including a province-wise breakdown and details on tax slabs for different property sizes and uses.

Updated Property Tax Rates for 2025

The property tax rates in Pakistan vary from province to province. Below is a breakdown of the latest property tax rates for residential and commercial properties as of 2025:

| Province | Property Type | Tax Rate | Additional Information |

| Punjab | Residential | 5% – 10% of ARV | Lower rates for small residential units |

| Commercial | 15% – 30% of ARV | Higher rates for shops, plazas, and offices | |

| Sindh | Residential | Rs. 100 – Rs. 500 per sq.ft | Tax based on square footage for residential |

| Commercial | Rs. 250 – Rs. 600 per sq.ft | Variable based on usage, location, and size | |

| KPK | Residential | Rs. 5,000 – Rs. 10,000 per property | Lower rate for smaller residential units |

| Commercial | Rs. 200 – Rs. 500 per sq.ft | Lower rates for rural areas, higher in cities |

Different Slabs for Property Size & Use

Each province applies different tax slabs based on property size and its use (residential or commercial).

Residential Properties:

- Smaller Houses: Typically taxed at the lower slab (5% to 7% of ARV).

- Larger Houses: Taxed at a higher slab (8% to 10% of ARV).

- Apartments/Flats: Usually taxed at a lower rate in urban areas, with specific rates applied based on size and location.

Commercial Properties:

- Shops: Taxed at a higher rate (15% to 20%) because of their income-generating nature.

- Plazas/Offices: Typically taxed at the highest slab, ranging from 20% to 30% of ARV, depending on location and business activity.

Other Considerations:

- Rural vs. Urban: Rural properties often enjoy lower tax rates compared to urban properties.

- Usage: Properties used for business are taxed at higher rates than residential ones, regardless of size.

How to Calculate Property Tax Using Online Tools (2025 Guide)

Learn how to easily calculate your property tax using official Excise & Taxation Department portals, provincial websites, and mobile apps in 2025.

Excise & Taxation Department Portals

The Excise & Taxation Department in each province offers online portals for property tax calculation. These portals are updated with the latest rates and allow residents and commercial property owners to calculate property tax based on their property details.

Punjab Urban Unit Portal (2025)

- The Punjab Urban Unit website offers an online property tax calculator that helps property owners determine their annual tax liability.

- Users need to input their property details like property type, size, and location, to get the accurate tax amount.

➤ Portal Link: https://urbanunit.gov.pk

Sindh Property Portal (2025)

- The Sindh Excise & Taxation Department provides an official property tax portal for Sindh residents.

- This portal also includes options to pay taxes online, check outstanding dues, and calculate taxes based on the property’s square footage and location.

➤ Portal Link: Sindh Property Portal

Mobile Apps for Property Tax Calculation (2025 Updates)

In 2025, several mobile apps have been introduced by the Excise & Taxation Departments in Punjab and Sindh to make property tax payments and calculations more convenient for citizens.

Punjab Property Tax App (2025)

- The Punjab Property Tax Mobile App enables users to easily calculate property tax, track payment history, and pay taxes online via a secure gateway.

- Available on both Android and iOS.

Sindh Property Tax App (2025)

- Sindh’s official property tax app offers similar functionalities.

- Users can calculate tax, view property details, and make online payments through the app.

- Available on both Android and iOS.

Note: Keep your property details ready (e.g., property type, market value, ARV) to quickly use the app or portal.

Common Mistakes While Calculating Property Tax

Learn about the most common errors people make while calculating property tax and how to avoid them for accurate calculations in 2025.

1. Ignoring Location-Based Multiplier

One of the most common mistakes when calculating property tax in Pakistan is ignoring location-based multipliers.

- Location has a significant impact on your property tax, as it affects both the Annual Rental Value (ARV) and the tax rate.

- Urban areas such as Lahore, Karachi, and Islamabad tend to have higher tax rates compared to rural areas due to the higher potential for income generation.

- Many users mistakenly apply a standard tax rate without considering the specific multiplier for their location.

Tip: Always check your property’s exact location multiplier on the official Excise & Taxation Department portal or mobile app to get the most accurate tax calculation.

2. Using Outdated ARV (Annual Rental Value)

Another frequent mistake is using outdated ARV figures, which do not reflect the current market conditions.

- The ARV is typically revised annually, and using outdated values can lead to incorrect tax amounts.

- For example, rents in an area might have increased, or the market value of the property might have changed, which directly impacts the ARV and, subsequently, the property tax.

Tip: Always double-check the latest ARV using the official portals or app to ensure you’re calculating the tax based on the most recent data.

3. Missing Exemptions

Many property owners fail to apply the exemptions available to them, resulting in higher-than-necessary tax payments.

- Common exemptions include properties owned by government entities, religious places, or certain charitable organizations.

- Residential properties used by senior citizens or those that are low-income may also qualify for tax exemptions or reductions.

Tip: Always review the list of exemptions on your provincial property portal and ensure you’re claiming all that apply to your property.

Summary of Common Mistakes:

| Mistake | Solution |

| Ignoring location-based multiplier | Always factor in location-based tax adjustments. |

| Using outdated ARV | Ensure the ARV is updated and reflects market value. |

| Missing exemptions | Check for applicable exemptions based on property type or ownership. |

Property Tax Exemptions & Rebates in 2025

Explore the available property tax exemptions and rebates in 2025, including benefits for senior citizens, government employees, and more.

1. Exemptions for Senior Citizens (2025)

In Pakistan, senior citizens (aged 60 years or above) are entitled to certain property tax exemptions or rebates as a form of relief.

- Residential Property: Senior citizens may receive a complete exemption on property tax for their primary residence. This is applicable to properties that are not rented and are used solely for personal residence.

- Eligibility Criteria: The property must be owned by the senior citizen, and it must be their primary residence.

Tip: Ensure that you have all necessary documentation to prove your eligibility, such as your NADRA card and property ownership documents.

2. Exemptions for Government Employees (2025)

Government employees are also eligible for property tax rebates or exemptions, especially if the property is used for residential purposes.

- Eligibility: Active government employees who own residential properties are eligible for property tax rebates. This is usually offered as a percentage reduction on the total tax payable.

- Special Considerations: Government employees may also be eligible for reduced rates based on their salary grade and the location of the property.

Tip: Check your eligibility and apply for any special rebates through the Excise & Taxation Department in your province. Some rebates may also apply if the government employee is retired or has worked in public service for a long period.

3. Other Common Exemptions

In addition to senior citizens and government employees, other common exemptions include:

- Charitable organizations and religious institutions (e.g., mosques, temples) often qualify for full property tax exemption.

- Agricultural land used for farming may be exempt from property tax in some provinces.

Summary of Property Tax Exemptions & Rebates for 2025:

| Category | Exemption or Rebate |

| Senior Citizens | Full exemption on primary residence |

| Government Employees | Rebate or reduction based on eligibility |

| Charitable/Religious Institutions | Full exemption |

| Agricultural Land | May be exempt from tax in some provinces |

Agricultural Land Exemption (in Some Cases)

In some provinces, agricultural land may be exempt from property tax if it is being used primarily for farming purposes. This exemption is generally applied in rural areas where the land is cultivated for agriculture and is not used for commercial or residential purposes.

- Eligibility: The land must be actively used for farming or agricultural activities. Non-cultivated land, or land used for purposes like residential development or commercial enterprises, may not qualify for exemption.

- Provincial Variation: The rules for agricultural land exemptions can vary by province. For example, Punjab may have different policies compared to Sindh or KPK. Always check the local Excise & Taxation Department for specific regulations.

Tip: Ensure that you are using the land solely for agriculture and have proof of farming activity to claim this exemption. Contact the local authorities to get detailed information for your area.

How to Pay Your Property Tax in Pakistan

Explore the various options available for paying your property tax in Pakistan, including convenient online payment methods and traditional offline options.

1. Online Payment Methods (2025 Updates)

In 2025, paying your property tax online in Pakistan has become simpler with the introduction of several secure platforms.

ePay Punjab

- ePay Punjab is an online platform introduced by the Punjab Government for property tax payment.

- Features: Allows users to pay their property taxes securely using credit/debit cards or bank transfers.

- How to Pay: Visit the ePay Punjab portal, enter your property details, and make payment directly from the website.

➤ Portal Link: ePay Punjab

JazzCash

- JazzCash, a leading mobile payment service, also allows property tax payments for many provinces.

- Features: You can easily transfer funds from your JazzCash mobile wallet to pay your property tax through the JazzCash app or the USSD code.

➤ JazzCash App: Available for download on Android and iOS.

Other Online Payment Gateways

- Bank’s Mobile Apps: Many banks like UBL, Bank Alfalah, and Faysal Bank offer property tax payment features via their mobile apps.

- Nadra Online Payment System: Some provincial portals also allow payments directly through NADRA’s online system.

Tip: Ensure that you are using the correct property details and have access to an internet banking service or mobile wallet for smooth transactions.

2. Offline Payment Methods (2025)

If you prefer offline payment methods, there are still various ways to pay your property tax in Pakistan.

Bank Challans

- Bank Challans are the traditional method of paying property tax. You can download the challan form from the Excise & Taxation Department’s portal or get it from local banks.

- How to Pay: Fill out the challan form, deposit the amount at any designated bank branch and receive a stamped receipt.

- Payment Locations: Available at branches of National Bank of Pakistan (NBP), United Bank Limited (UBL), Bank Alfalah, etc.

NADRA Kiosks

- NADRA kiosks in many cities also accept property tax payments. These kiosks are usually located in commercial areas or shopping malls.

- How to Pay: Visit a NADRA kiosk, provide your property details, and make the payment via cash or bank transfer. You’ll receive an official payment receipt.

Summary of Payment Methods:

| Payment Method | Available Options | Features |

| Online Payments | ePay Punjab, JazzCash, Bank apps | Convenient, secure, 24/7 availability |

| Offline Payments | Bank Challans, NADRA Kiosks | Traditional, available at bank branches and kiosks |

Tips to Reduce Your Property Tax Legally

Learn how to reduce your property tax legally with these simple yet effective tips. Avoid penalties, claim exemptions, and categorize your property correctly.

1. File Early to Avoid Penalties

One of the most effective ways to reduce your property tax burden is by filing early and avoiding late penalties.

- Penalties for Late Filing: In Pakistan, if you fail to file your property tax on time, you may face a penalty or interest charges on the due amount. These penalties can add up quickly and increase your overall tax liability.

- Early Filing Benefits: By filing your property tax before the deadline, you ensure you pay the exact amount without any additional charges. You can also plan your finances accordingly.

Tip: Mark your calendar for the property tax filing date and ensure that you submit your payment as early as possible to avoid unnecessary fees.

2. Apply for Exemption if Eligible

Many property owners miss out on significant tax exemptions. If you’re eligible for an exemption or rebate, applying for it can significantly reduce your tax liability.

- Who is Eligible?: Senior citizens, government employees, religious institutions, and agricultural landowners are just some of the categories that may qualify for exemptions or rebates.

- How to Apply: Make sure you have the required documentation, such as NADRA cards, ownership documents, and proof of eligibility for specific exemptions. Apply through the Excise & Taxation Department website or visit their office for more details.

Tip: Always double-check the exemption criteria for your specific property before filing. A simple exemption application can save you a considerable amount.

3. Correct Property Categorization

Incorrect property categorization can lead to you paying higher property taxes than necessary. It is important to ensure that your property is categorized correctly by the Excise & Taxation Department.

- Residential vs. Commercial: Ensure that your residential property is not mistakenly categorized as commercial. Commercial properties often have higher tax rates.

- Agricultural Land: If your property is primarily used for farming, make sure it is categorized as agricultural land to claim potential exemptions.

- Reclassification Requests: If you notice an error in your property categorization, request reclassification by submitting the necessary documents to the local Excise & Taxation office.

Tip: Review your property classification regularly and request a reclassification if you believe it’s incorrect. This can lower your tax burden and ensure you’re not overpaying.

Summary of Tips to Reduce Property Tax Legally:

| Tip | Action | Benefit |

| File Early | Submit property tax before deadlines | Avoid penalties and extra charges |

| Apply for Exemption | Claim exemptions if eligible | Reduce tax by qualifying for rebates |

| Correct Property Categorization | Ensure proper classification | Avoid overpaying for misclassified properties |

Final Thoughts: Know Your Numbers, Avoid Penalties

Stay informed to avoid penalties and overpaying your property tax.

Encourage Awareness

- Know Your Property’s Value: Stay updated with ARV and tax rates.

- File Early: Avoid penalties by submitting your tax on time.

- Apply for Exemptions: Claim applicable rebates to reduce your liability.

- Ensure Correct Categorization: Correct property classification helps avoid higher taxes.

Tip: Regularly check your property details and file on time to save money.

Frequently Asked Questions (FAQs)

Q1: How is Pakistan’s ARV determined?

The market value of the property and its potential for rental income generation are the basis for calculating ARV (Annual Rental Value). The Excise & Taxation Department calculates it based on the location, size, and condition of the property.

Q2: Do all provinces have the same property tax?

No, each province has its own property tax rates and computations (Punjab, Sindh, KPK, etc.). Tax rates, exemptions, and refunds vary by province and are determined by local laws.

Q3: What is the process for obtaining a duplicate property tax bill?

Visit your local Excise & Taxation Department office or utilize your province’s online portal to obtain a duplicate property tax bill. Details about your property must be provided, and if necessary, a small charge must be paid.

Q4: What happens if I fail to pay property taxes?

You risk fines, interest, and possibly legal action if you fail to pay your property tax. The government may occasionally take your property to recoup outstanding debts.